State Bank of India is the biggest bank or financial institution that is operating in India, and they are always found to be working on one or the other thing to make banking easier and safer. There are many security features that are offered by SBI to make things safer for their account holders. One of the most common thing that is used by every bank is the OTP or the One Time Password. Today I will be telling you how you can use the SBI Secure OTP or State Bank Secure OTP app to generate OTP.

Every one of us these days uses the electronic payment services it might be IMPS, NEFT, RTGS, or even UPI everything is secured by one or the other way. But the most common thing that is used to make the transactions secure is the OTP. If you want to make any of the transactions with the help of your internet banking account then you have to enter the OTP that you receive on your registered mobile number. In the case of UPI, you will have to enter your BHIM UPI PIN to carry out the transactions.

But wait, how do you normally receive your one time password?

Usually, you will be receiving an SMS from the bank on your registered mobile number.

What is the Registered Mobile Number?

Here you should understand what is the meaning of the term registered mobile number.

This is the mobile number which you have provided the bank as your primary mobile number to communicate. The bank will be sending all the important alerts about your bank account number to this number. In other words, I can define the registered mobile number as the mobile number to which you receive your bank account transaction alerts.

Those alerts can be regarding any kind of transactions taking place in your bank account i.e. debit transaction, credit transaction or any login alerts of internet banking, etc.

What is OTP or One-time Password?

OTP is a code that can be numerical or alphanumerical which is sent to you by the bank to make sure that you are the real owner of the bank account who is authorized to carry out the transactions.

You will be receiving the OTP whenever you want to make any transactions with the help of your bank account. It can be about fund transfer, mobile banking or any updates to your bank account.

For example,

You want to use your atm card or debit card to make payment for some e-commerce websites. You will have to enter your debit card number and other details in the payment gateway.

Once you enter all the details in the prescribed fields of payment gateway you will be redirected to your bank’s website.

Within that period of time, your bank will be sending you an SMS in which you can find some code which is nothing but the one-time password.

Now you are required to enter that code correctly in order to complete the transaction successfully. The code which you receive via SMS is nothing but the OTP.

Note: You should never share your bank account details like ATM PIN, OTP and BHIM UPI with anyone. And no one from the bank will ask you for these details.

In today’s article, I will be telling you about the State Bank Secure OTP App which can be used to generate OTP for your online internet banking transactions.

What is the Use of State Bank Secure OTP App?

Before, I tell you the real use of this app I would like to tell you that this application is also called as SBI Secure OTP. Make sure you don’t get confused about the name of the app, but you should always make sure that you download and install the application from the authorized source.

You can use State Bank Secure OTP or SBI Secure OTP to generate the OTP for your internet banking transactions without the need of receiving it via SMS.

This means you can carry out your online transactions without having to receive the OTP on your registered mobile number. You can generate the one time password using this app on your smartphone.

But to generate it you will have to register and activate State Bank Secure OTP application on your smartphone. I will be telling you the way to install and activate this application on your smartphone in this article.

How to Use State Bank Secure OTP App?

So now we know enough things about the SBI Secure OTP application and what is the real use of this application which is developed by the State Bank of India. The further part of this article will be dealing with how to use State Bank Secure OTP App and Generate OTP for your online transactions.

Step 1: Download and Install State Bank Secure OTP application on your smartphone from the authorized source. (Google PlayStore or iTunes only)

Step 2: Open the application on your smartphone after installation.

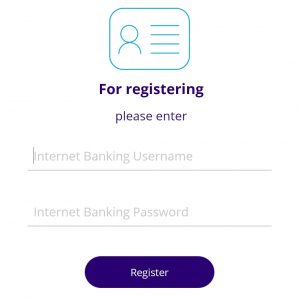

Step 3: Enter your Internet Banking Username and Password in State Bank Secure OTP App.

Step 4: Enter the OTP in the app which you will be receiving on your registered mobile number. You will now receive an activation code on your registered mobile number.

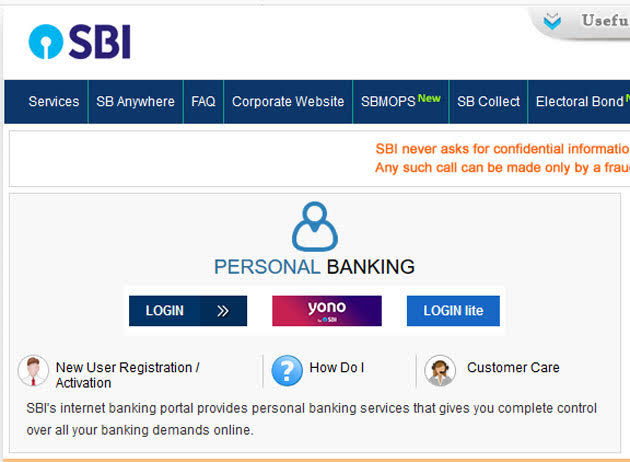

Step 5: Go to SBI Online on your desktop or laptop computer.

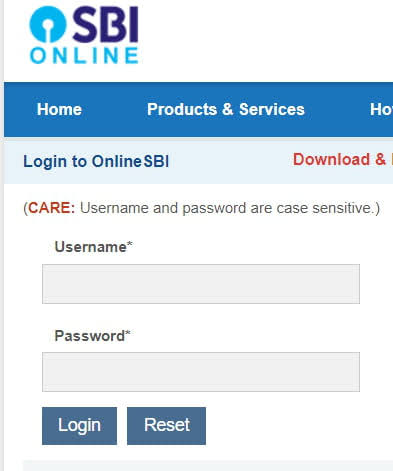

Step 6: Log in to your internet banking account by entering your username and password.

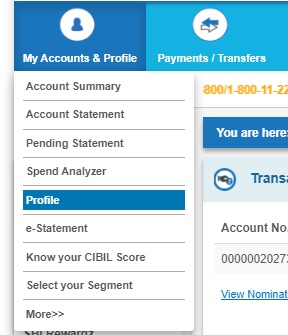

Step 7: Click on My Accounts & Profile.

Step 8: Click on Profile

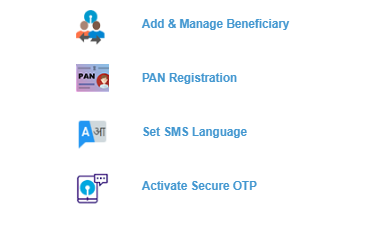

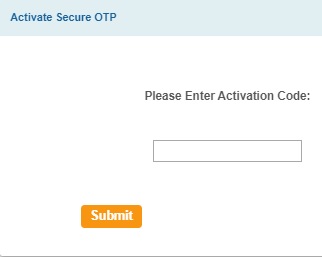

Step 9: Click on Activate Secure OTP

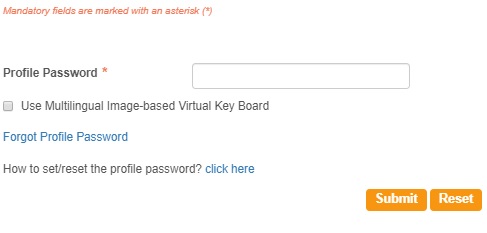

Step 10: Enter your Internet Banking Profile Password.

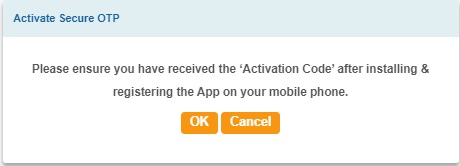

Step 11: Now enter the SBI Secure OTP Activation code that you have received via SMS after step 4.

Step 12: Follow the on-screen instructions to activate the SBI Secure OTP Application.

After completing these 12 steps you have registered for State Bank Secure OTP Application. Now you will be able to generate OTP for your internet banking transactions using your smartphone.

| Official Download Links of State Bank Secure OTP App | |

| Android Users | Google PlayStore |

| Apple Users | iTunes |

Make sure that you download the app on your smartphone using the links which are provided above. If you don’t want to use these then find it from Google PlayStore or iTunes which will be even better for you.

If you want in-depth guide for all these steps then you can find it below. All the steps have been explained along with the required screenshots.

The first thing which you have to do is install the SBI Secure OTP application on your device or smartphone. I have already told you that you have to install it from the authorized source only.

You should always make sure that you won’t install any of the banking application from the 3rd party link and by using any of the APK files if you are using Android.

I have mentioned the links above which are official. But you can also search for the app in your Google PlayStore or iTunes.

Once you have installed it open the application to proceed with the registration

If you have successfully installed the application on your smartphone from the trusted source we have done half of the job. Now you need to enter your internet banking username and password in the application.

The bank will also send you an activation code, make sure you don’t delete that SMS until you complete the process of registration.

But to receive the OTP you will have to tap on the button Send OTP which you will find in the application once you enter the correct username and password.

There are some terms and conditions of use which should be read by you and then you can continue the process of registration.

You have to set 4 digit mPIN in this step which you will be using to generate the one time password.

When you set your mPIN then you have completed all the steps which need to be completed on your smartphone. Now you have to open the internet banking interface (SBI Online) on your desktop or laptop computer.

You have to enter your correct username and password to login to your internet banking account. In case you have multiple internet banking accounts then make sure you enter the details of the right bank account.

After you successfully log in to your internet banking account click n My Accounts & Profile which you will find in the top menu of the internet banking interface.

When you click on the Profile option you will be taken to the profile section of your internet banking interface.

All the important options related to your SBI Online Profile can be found in this section. Click on Activate Secure OTP.

You will be asked to enter your Profile Password when you click on Activate Secure OTP. This is important to proceed further.

And once you enter your profile password and move further you will receive an SMS from the bank stating that you have accessed the profile section of your SBI Online.

After completing the 4th step you will be receiving an OTP and the Activation code. You have to enter the same activation code in this step.

You are almost done and you have completed the activation process of SBI Secure OTP.

This application can be used by any of the account holders of SBI who have activated the internet banking feature of their bank account. If you have your internet banking username and password then you can use this application to generate OTP for your internet banking transactions.

Yes, you can use this application even if you have only enquiry rights of your internet banking. But you can use this only for a few activities like LPG registration, Windows App registration, etc. If you want to take full advantage of this application then you need to have full rights of internet banking. You can upgrade your rights to take full advantage.

SBI Secure OTP is used to generate OTP for your internet banking transactions. This will replace the need of receiving the one time password over SMS to your registered mobile number. You can use this application to generate the OTP which can be used to proceed with and complete your internet banking transactions. But to generate OTP using this application you need to activate and register the application on your smartphone.

No, there is no requirement of the SIM Card of the mobile number that has been registered with your bank account. But while you register the application on your smartphone you will receive the OTP on that mobile number. Later on, you will receive the activation code on that mobile number. Once you enter the OTP and the Activation code in your internet banking account you will not require the SIM Card of Registered Mobile Number. You will be able to generate the OTP with the help of internet connectivity.

If you want to use SBI Secure OTP then you can install it from Google PlayStore, iTunes, etc. but you should make sure that you download and install it from the authorized place. You should never download it from any of the third-party sources.

To register first you have to install the application on your smartphone, enter your internet banking credentials. You will receive an OTP on your registered mobile number. Enter that OTP in the application, later on, you will receive an activation code via SMS to your registered mobile number. Enter the activation code in prescribed place in your internet banking interface to register the application and start using it.

No, you can not use State Bank Secure OTP on multiple mobile phones or smartphones. In case you want to use this application on a new mobile phone then you need to first de-register from the previous phone and register on the new phone. But you can not simultaneously use State Bank Secure OTP App on multiple phones.

If you have lost the smartphone on which you have registered and activated State Bank Secure OTP then immediately you need to de-register this service of your internet banking account.

If you enter the mPIN wrong 3 times then the application will reset automatically. You again have to follow the same procedure to again register and activate State Bank Secure OTP to continue using it.

With the help of this application, you can generate one time password for online as well as offline transactions. Along with this, you will be having the option to change your mPIN and also to de-register this service on your smartphone.

If you don’t want to use the application to receive the OTP with the help of this application. Then you can de-register with the help of the de-register option given in the settings menu within the application. In case you are facing any difficulties then you can also use internet banking too. Who can use SBI Secure OTP Application?

I have only Enquiry Rights of Internet Banking Can I Use SBI Secure OTP?

What is the Use of this State Bank Secure OTP?

Should I have the SIM Card of Registered Mobile Number to Receive OTP?

How do I get the SBI Secure OTP Application?

How do I Register to the Application?

Can I use the SBI Secure OTP on Multiple Mobile Phones?

What if I lost my phone where the Secure OTP App has been registered? How do I perform Internet Banking transactions now?

What happens if I forgot my mPIN for the Application?

What are the options available in the State Bank Secure OTP App?

How do I de-register the application from mobile?

Conclusion

So this was everything that you should know about the State Bank Secure OTP App or SBI Secure OTP App. I hope you now know how you can activate this app and generate OTP for your online transactions. If you have any kind of doubts in your mind then you can comment down below. And you can even talk to the customer care executive of SBI by calling them on their toll-free number: 1800 425 3800 to get assisted quickly.