Everybody wants to earn more money, everybody wants to multiply the money they have with them. But not everyone takes a firm step to multiply or I would say increase the amount of money they have with them. And I am very happy that you are taking a good step to invest your money in a good investment instrument. I am talking about the fixed deposit which you are thinking to open or start. In this article of mine, I will be telling you the steps which you need to follow to open fixed deposit in IDFC First Bank.

This will be an in-depth article in which I have tried my best to cover each and every aspect which you need to know about the fixed deposit account in IDFC First Bank. So what I recommend you is to read this whole article very carefully so that you don’t miss out on any of the vital information about the procedure to open fixed deposit in IDFC First Bank. After all, you are investing your hard-earned money somewhere and it is important that you know everything about the place where you are investing your money.

I am one of the bank account holders of IDFC First Bank and I am one of those people who are very happy with the services which IDFC Bank offers to their account holders. I have no complaints about the services that the bank offers nor with the interest rates they offer for my money. What are your views about the bank and its services? Communicate your views to me by commenting down below, we have a comment box at the end of this article. They offer up to 7% interest rates on the balance of Savings Bank Account itself that is what amazes me a lot.

Because we are getting good banking services, as well as the interest rates which they are offering, are great. Of course, you should have a balance of more than Rs. 1,00,000 to gain interest rates of 7%. Ok, so that was about the interest rates of the savings bank account. But the main matter of the day is about the IDFC Fixed Deposit Account. Don’t worry I will tell you about the interest rates of fixed deposit as well. Just keep reading I won’t be disappointing you with this article. But before we proceed to the further part of this article and check out the steps to open fixed deposit in IDFC First bank. Let us understand the fixed deposit in a proper manner.

About IDFC First Bank

| Type of the Bank | Private Bank |

| Traded As | BSE: 539437 NSE: IDFCFIRSTB |

| Industry | Banking and Financial Services |

| Predecessor | IDFC Bank and Capital First Limited |

| Founded | October 2015 |

| Head Quarters | Mumbai, Maharashtra |

What is a Fixed Deposit?

A fixed deposit is a financial instrument that is provided by the bank. The account holders can get more rate of interest when compared to that of the regular savings bank account. But there is a catch in this thing and that is you can not withdraw or take out your money before the maturity date.

And if you want to withdraw your money from the fixed deposit account then you will have to pay 1% to 2% of the total principal amount as penalty.

Along with that, you won’t be getting any kind of interest on your principal amount. This is how the fixed deposit works. There are some banks that allow partial withdraw without applying penalty on you. But I strongly recommend you to talk to the bank about the premature fixed deposit closure.

It is important to know about the consequences of premature fixed deposit closure before you open fixed deposit in IDFC First Bank.

In simple terms, we can define a fixed deposit as a financial instrument to get more interest rate compared to that of the regular savings bank account.

Important Things to Know Before Opening a Fixed Deposit

There are few other things which you should know and keep in your mind before you open fixed deposit in IDFC First Bank. I have mentioned those things below.

- Online or Offline FD.

- Penalty on Premature Closure of FD.

- IDFC First Fixed Deposit Interest Rate.

- Tenure of Fixed Deposit.

- Taxable income.

Online or Offline FD

You can open a fixed deposit online as well as offline. If you want to open a fixed deposit offline, then you will have to visit your home branch of IDFC First Bank where you opened and maintain your bank account.

There you have to talk to the bank officials about your plan to open fixed deposit in IDFC First Bank. They will tell you all the important things which you should know.

And finally, you will be able to open the FD with the help of the bank officials at your home branch. If you feel the response of the bank officials is not good then you can approach the branch manager as well. They will be happy to help you out in this matter.

But in case, you don’t want to visit your home branch then you can still open the FD with the help of your internet banking. The procedure which you need to follow is mentioned in this article.

Penalty on Premature Closure or FD

As I have already told you that there will a penalty based on the total principal amount of your FD. If you want to break it or close it before the maturity date. You should keep this thing in your mind because even 1% to 2% of your principal amount will be huge.

Even after paying the penalty you won’t be getting any kind of interest for the period your FD was active. So if you feel you can’t hold your money locked for a long period of time then you can choose a small tenure.

Tenure of Fixed Deposit

There will be fixed tenure or time period for every Fixed Deposit you open with the IDFC First Bank. You can choose from 7 days to 5 years of tenure as per your choice. But make sure you choose a correct one because you won’t be able to withdraw or take out your money within that period of time. You will have to pay the penalty if you do so.

You can read the different tenure and the IDFC First Bank Fixed Deposit Interest Rates in the above table.

Taxable Income

As per the current Income Tax rules in India, the returns or profits which you earn out the fixed deposits are considered as income and you will have to pay the tax on the returns you earn by your step to open fixed deposit in IDFC First Bank.

How to Open Fixed Deposit in IDFC First Bank?

Now we know enough things about FD so it’s time to check out the steps which you need to follow to open fixed deposit in IDFC First Bank. There are multiple methods that you can follow to open an FD in IDFC First Bank, I have mentioned those below.

- You can open FD by visiting the home branch. (Offline Method)

- And you can open FD through Internet Banking. (Online Method)

Let us now discuss both of these methods.

- Go to your IDFC First Bank home branch.

- Tell the bank officials that you want to open an FD.

- Ask them the interest rates they are offering.

- Ask them the different tenures which are available.

- Take a Fixed Deposit Opening Application Form.

- Fill the form with correct details including the FD amount.

- Check the details and submit the fixed deposit opening application form.

You should note one thing, not all the IDFC First Bank branches provide a fixed deposit opening application form. Most of their branches work on a paperless basis. You will be getting an FD Advice or Receipt when you successfully open fixed deposit in IDFC First Bank.

However, it depends upon the branch to provide you an application form or follow the paperless mode to open your FD.

- Go to the official website of the IDFC First Bank.

- Click on Customer Login.

- Click on Personal and Business Banking.

- Enter your IDFC Bank Internet Banking Username.

- Enter your password and click on Login button.

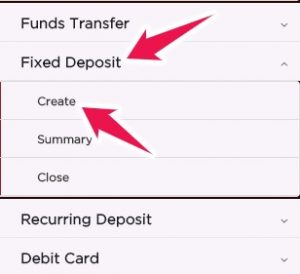

- Click on Fixed Deposit.

- Click on Create.

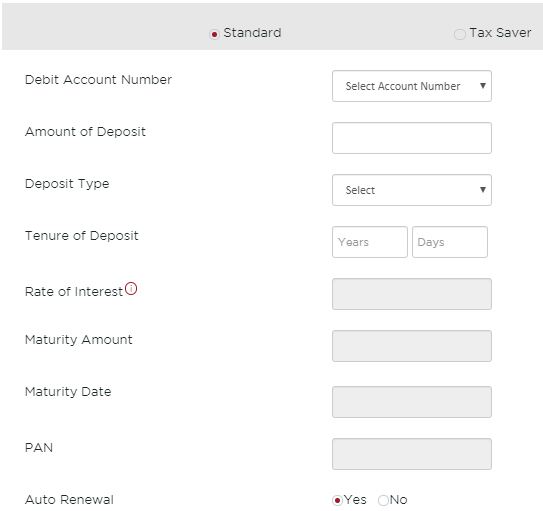

- Select the deposit type. (standard or tax saver)

- Select your debit account number.

- Enter the amount of deposit.

- Enter the tenure of the deposit.

- Enter your PAN Card number.

- Select if you want to auto-renew. (yes or no)

- Click on the Next button.

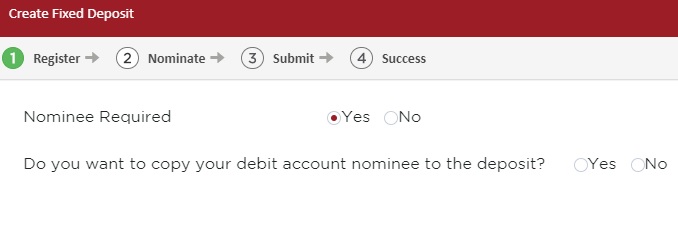

- Enter the nominee details and click on next.

- Your fixed deposit details will be displayed to you on the screen.

- Click on Accept and follow the on-screen instructions.

These are the 17 steps that you need to follow to open fixed deposit in IDFC First Bank. You should be very careful during all these 17 steps. If you don’t know how to use internet banking properly then I recommend you to go to the home branch and open the FD offline.

- The minimum tenure for NRE Deposits is 365 days and NRO/ Domestic Deposits is 7 days. No interest is payable where the deposit has not been in place for applicable minimum tenure.

- The incentive for Senior Citizens will be at an additional spread of 0.50% over the above rate and will not be available for NRE or NRO Fixed Deposits.

- In case of premature closure of the Term/Fixed Deposit, interest will be paid basis interest rate applicable at the time of booking the term/fixed deposit, for the corresponding period for which deposit has remained with the bank. Additionally, term/fixed deposit if prematurely closed, would be subject to ‘Premature Closure Penalty’ as prescribed by the Bank on the date of deposit.

- The Interest thereon will be paid for the period for which the deposit has remained with the bank, after the application of the penalty.

- Term/Fixed Deposits of Senior Citizens and premature closure of Term/Fixed Deposit effected due to death of account holder/s are exempted from the said Premature Closure Penalty. The said Premature Closure Penalty shall be applicable and imposed on all Term/Fixed Deposits booked and/or renewed on or after May 2, 2019.

- Premature Closure Penalty will be applicable on Retail Term/Fixed Deposits & the same shall not be levied on Term/Fixed deposits of Government, Quasi-Government, Regulatory & Statutory bodies.

- Penalty for premature closure of Fixed Deposit would be at 1%.

- These rates displayed above applicable till revised further.

Conclusion

So this was almost everything which you should know about the Fixed deposit and the steps which you need to follow to open fixed deposit in IDFC First Bank. I hope you are clear with all the information which is mentioned in this article. If you have any kind of doubts in your mind then you can comment down below. And if you want to get assisted quickly then you can call the customer care of the bank.

How can I open fixed deposit in IDFC Bank?

You can open a fixed deposit in IDFC First Bank by following two methods. The first one is you can visit the home branch of your bank. And the second method is to use internet banking to open the fixed deposit.

Is IDFC Bank Safe for Fixed Deposit?

Yes, IDFC First Bank is totally safe for opening fixed deposits. If you already have a bank account with them then go to your home branch to open FD. And if you don't have a bank account with them then call the customer care of the bank and ask them for whatever details you want about the banking services offered by them including fixed deposits.

How can I open a fixed deposit account?

The process of opening a fixed deposit account is very easy all you need to have is a bank prior relationship with the bank like you should have a savings bank account with them. If you have it then it will hardly take 10 minutes to open a fixed deposit account.

Can we Open Fixed Deposit Without Bank Account?

Yes, you can open a fixed deposit without a bank account with the bank. There are such banks that allow to do it. But it is recommended to have a savings bank account the bank before you open an FD.

What is the interest rate of IDFC Bank?

The interest rates of savings bank account go up to 7% and the interest rates of fixed deposits are mentioned in the above article. The interest rates of FD depends upon the tenure you choose.

What is the use of fixed deposit?

With the help of fixed deposits, you can earn interest rates more than that of a savings bank account. This is the major use of fixed deposit.

What is the benefit of fixed deposit?

The major benefit of fixed deposit is that you will get more rate of interest when compared to that of savings bank account and current bank accounts.

Customer Care:

Customer Care: