NEFT stands for National Electronic Funds Transfers and RTGS stands for Real-Time Gross Settlement. Both of these systems are used to make funds transfer or money transfers. But they are not one and the same. There is a difference in NEFT and RTGS which I will be talking about in a while. On this page, you will find the download link of ICICI Bank NEFT and RTGS Form in PDF Format.

To download ICICI Bank NEFT and RTGS form the customer has to visit the official website of ICICI Bank. Go to the forms section and select NEFT and RTGS form. And the download of the form in PDF format will begin shortly. The download link provided below on this page can also be used to download the form.

What is NEFT and RTGS Form?

It is an application form that you have to fill if you want to make funds transfers using NEFT or RTGS system from the branch of ICICI Bank. You can obtain this form both in electronic form online (PDF Format) and in printed form from the branch where you wish to make the transfer.

What is the Difference between NEFT and RTGS?

Both these systems help us to make funds transfers but RTGS is used when someones want to make a transaction of Rs. 2,00,000 and above. And the NEFT system is mostly used when someone wants to make a transaction of value less than Rs. 2,00,000

Sections in ICICI NEFT and RTGS Form

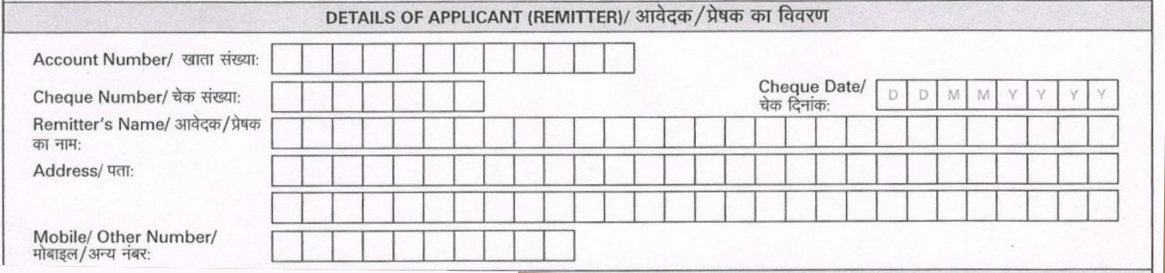

There are two sections in ICICI Bank NEFT or RTGS Form and they are, Details of Applicant (remitter) and Details of Beneficiary.

What to Fill in Details of Applicant (Remitter) Section?

While filling the form you have to fill the below-mentioned details of the applicant in the form.

- Remitter’s Account Number: If you want to deduct money from your bank account.

- Cheque Number: If you want to use Cheque for the NEFT or RTGS transfer.

- Remitter’s Name: The person who wants to do the NEFT or RTGS transfer.

- Address: The address of the person who is initiating the fund’s transfer.

- Mobile Number: The mobile number on which ICICI Bank can contact the remitter. (registered mobile number)

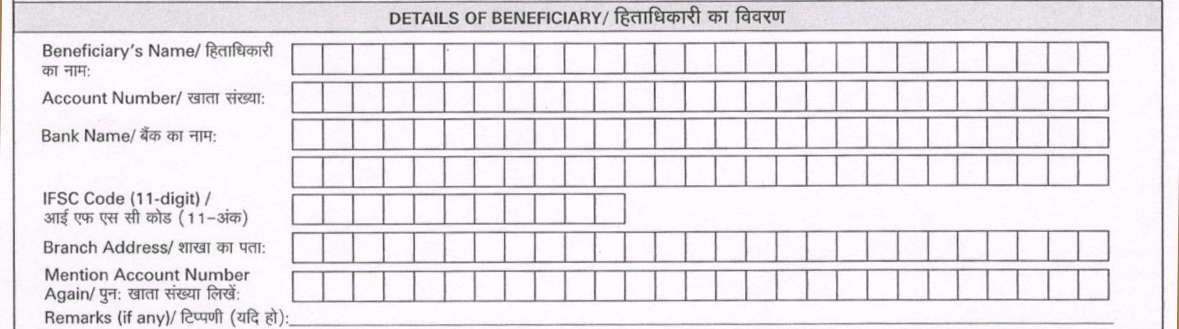

What to Fill in Details of Beneficiary Section?

This section of the form should be used to fill the details of the beneficiary to whom you want to transfer the money.

- Beneficiary’s Name: Mention The name of the person to whom you are sending the money.

- Beneficiary’s Account Number: The bank account number of the beneficiary who is receiving the money should be mentioned.

- Bank Name: The bank’s name where the beneficiary holds the account should be mentioned here.

- IFSC Code: The 11 digits Indian Financial System Code of the beneficiary’s branch.

- Branch Address: The address of the beneficiary’s home branch.

- Mention Account Number Again: Re-write the same account number of the beneficiary again.

Other than these two sections there is one more which is the top part where you have to fill the details like your name, account number, and how you would like to deduct the money from your bank account, etc.

Download PDF of ICICI Bank NEFT or RTGS Form

Follow this link to download the ICICI Bank NEFT or RTGS Form in PDF Format.

ICICI Bank NEFT Transaction Charges

If you do NEFT Transfer using the online modes like internet banking, Mobile App, Mera Mobile app, and Pockets app there is no NEFT transaction charges applied.

| Transaction Amount | NEFT Charges |

| Up to Rs. 10,000 | Rs. 2.25 + GST |

| Above Rs. 10,000 to Rs. 1,00,000 | Rs. 4.75 + GST |

| Above Rs. 1,00,000 to Rs. 2,00,000 | Rs. 14.75 + GST |

| Above Rs. 2,00,000 to Rs. 10,00,000 | Rs. 24.75 + GST |

ICICI Bank RTGS Transaction Charges

There are no RTGS transaction charges applied to you if you do it using Internet Banking, iMobile app, Mera iMobile app, and Pockets app.

| Transaction Amount | RTGS Charges |

| Above Rs. 2,00,000 to Rs. 5,00,000 | Rs. 20 + GST |

| Above Rs. 5,00,000 to Rs. 10,00,000 | Rs. 45 + GST |

Conclusion

So this is how you can download the ICICI Bank NEFT Form and ICICI Bank RTGS Form in PDF format. The charges on the transaction are applied only when you do the transfer from the branch of the bank. If you want to save the charges then you can use the modes like Internet Banking and Mobile banking of the bank to transfer money.