We are moving towards the cashless economy and this means the raise of the electronic payment apps and services. We are seeing a huge surge in the companies that are offering the services for the cashless economy. Since we have got the Unified Payment Interface (UPI) Every company wants to get into this market. But every bank had it’s own mobile banking application even before UPI was introduced by the Government of India. Today in this guide I will be telling you everything you need to know about the YONO Cash and how you can withdraw money from ATM without having your debit card.

ATM Card or Debit Card are helping us to travel without carrying cash with us. But there are consequences when we forget our card at home. But what if you want urgent cash now and you don’t have your card with you? State Bank of India has come up with the solution to this problem. I have been using State Bank of India as my primary bank for many years now. And I have seen State Bank introducing its existing features, functions and upgrading the existing ones. The mobile banking and internet banking infrastructure which is with the State Bank of India has is excellent. I have never come across technical glitch with these things.

About State Bank of India

| Headquarters | Mumbai |

| Formerly Known As | Imperial Bank of India |

| Founded On | 1st July 1955 |

| Type of Bank | Public Sector Bank |

| Chairman (Augusr 2020) | Ranjnish Kumar |

| Owner | Government of India |

| Number of Employees | 257,252 (March 2019) |

| Owner of the Bank | Government of India |

| Official Website | sbi.co.in |

| Revenue (2019) | ₹2.79644 trillion |

| Operating Income (2019) | ₹554.36 billion |

| Net Income (2019) | ₹8.62 billion |

| Total Assets (2019) | ₹36.80914 trillion |

| Customer Care (toll-free) | 1800 425 3800 |

Currently, SBI has published 29 banking applications on the Google PlayStore. Every app is for a reason but YONO by SBI is for many reasons. How about learning more about the features that are offered by this banking app?

What is YONO by SBI?

YONO by SBI is one of the many mobile banking applications that are offered by the State Bank of India. As I have already mentioned that there are 29 banking applications that have been published by SBI on Google PlayStore. Every app published serves its own area of services.

When it comes to YONO by SBI it is a digital banking platform that will help you to do everything that you can do with any of the mobile banking applications. You can access your bank account and carry out banking transactions. You can also make use of this application to use commercial services like booking train tickets, making investments, raising services requests, etc.

I will mention all the features of this mobile banking application more clearly a digital banking platform in the further part of this guide.

Full-Form of YONO

But before I tell you the features of YONO by State Bank of India, I want to tell you the full form of this term.

Full-Form of YONO: You Only Need One

Features of YONO by SBI

I have mentioned all the features that are offered by this application below.

- You can view your bank account(s) balance.

- YONO Pay can be easily accessed.

- The very famous YONO Cash is a part of this mobile application.

- Deposits that you have with the SBI can be viewed, created and altered with this application.

- You can make investments and view your already made investments with the State Bank of India.

- The details about your loans with the SBI can be viewed in this app.

- Details of your credit card can be viewed and accessed.

- You can apply for a new SBI Credit Card and link your existing card with your YONO.

- Insurance policies can be purchased and viewed with this application.

- You can shop and order things from various E-Commerce websites through the app.

- Best shopping offers can be viewed within the app.

- Service requests can be made.

- You can make the bill payments.

- Train tickets can be booked.

- SBI Rewards details can be accessed with the help of the YONO Application.

- If you need help in any case then you can access the FAQs.

- Any nearest branch or ATM Machine can be found.

- And finally, you can also get in touch with the customer care of the bank.

What is YONO Cash?

Now we know about the YONO by SBI, its features, the full form and the other important things about the State Bank of India.

It’s time to get into the major part of this guide and that is about the YONO Cash.

What exactly is YONO Cash?

YONO Cash is a feature that lets the account holders of SBI withdraw money from the ATM Machines without using the ATM Card or Debit Card. A unique transaction ID will be generated and secured with a PIN which will be later used to withdraw money without using the ATM Card or the debit card.

How to Use YONO Cash to Withdraw Money Without ATM Debit Card?

We have discussed almost everything that you need to know about the YONO Cash. Now I will tell you how exactly you can use YONO Cash to withdraw money without using your physical ATM Card or Debit Card. The steps are very simple but you need to be very careful when you are trying to use YONO Cash to withdraw money.

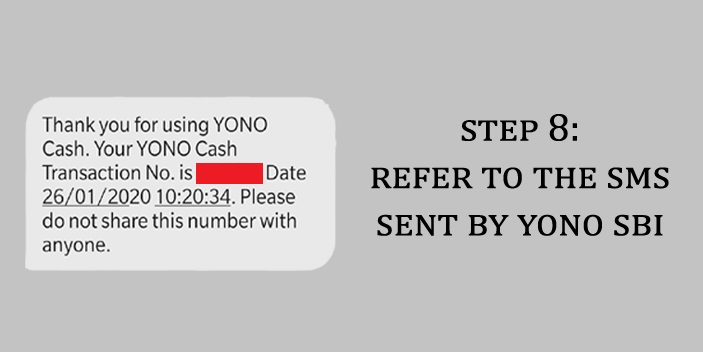

When you successfully complete all the steps which you are mentioned below to use YONO cash you will be getting a transaction number from State Bank of India via SMS.

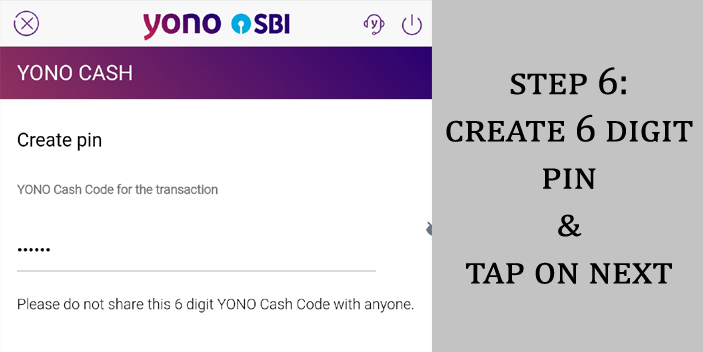

You should make sure that you don’t share your transaction number with anyone. But before you get the transaction number from the bank you have to enter the amount and set 6 digits YONO Cash PIN in the digital banking mobile application.

Just like the YONO Cash transaction number you should also don’t share your 6 digits PIN number with anyone. If you share it then anybody can withdraw money from your bank account using these two details. That is the reason why all the bank which are operating in India keep notifying the bank account holders not to share the details like OTP, Passwords, Username and the other confidential details with anyone. And the bank will never ask you to share any of these details via call, SMS or E-Mail.

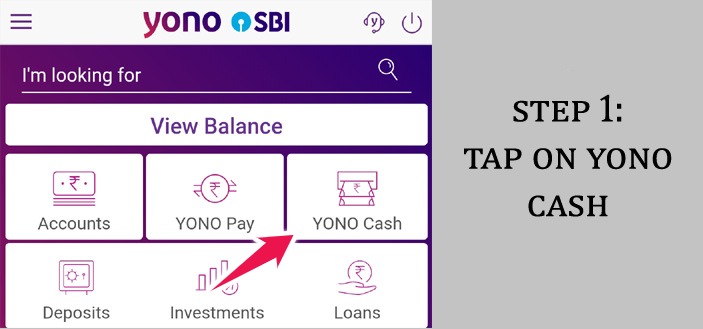

- Open the application and tap on YONO Cash.

- Tap on Request New.

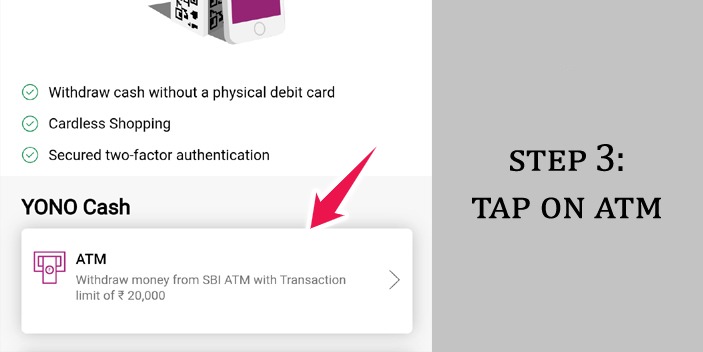

- Tap on ATM.

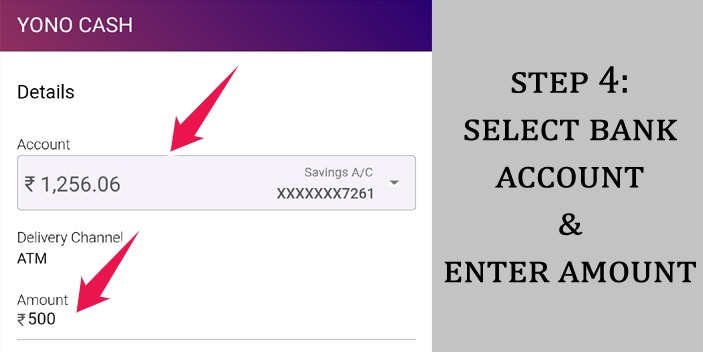

- Select the bank account from the drop-down menu and enter the amount of YONO Cash you want to withdraw.

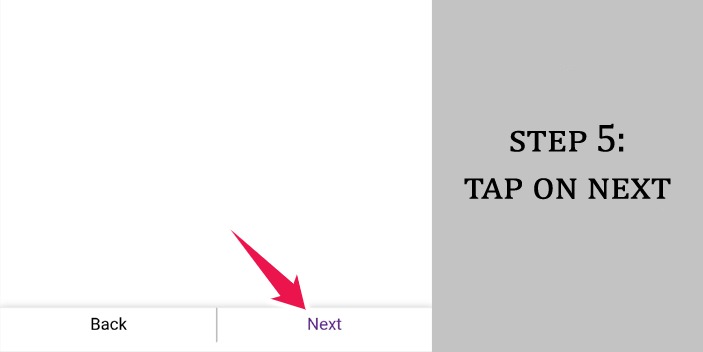

- Tap on Next.

- Set 6 digits YONO Cash PIN for your transaction.

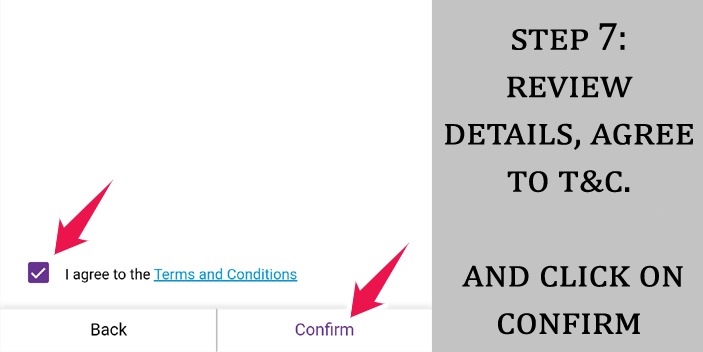

- Review the YONO Cash details, agree to the terms and conditions and click on confirm.

- Refer to the SMS sent by YONO SBI. The bank will send you the transaction number.

- Visit any of the YONO Cash Points which are near to your location.

- Choose YONO Cash from the ATM Screen.

- Enter the YONO cash transaction number you received via SMS.

- Enter the amount you want to withdraw from your bank account.

- Enter the 6 digits YONO Cash PIN Number which you have set in the application.

These are the steps that you need to follow to use YONO Cash to Withdraw Cash without ATM Debit Card. Currently, there are no charges which you have to pay to the State Bank of India to use this feature.

The maximum amount which you can withdraw using the YONO Cash is Rs. 10,000 per transaction. As I have already told you that you should not share your transaction number and the 6 digits YONO Cash PIN with anyone.

Conclusion

So this is how you can use YONO Cash to Withdraw Money without ATM Debit Card in State Bank of India. I hope you are clear with all the steps which I have mentioned in this guide. If you have any kind of doubts in your mind then you can comment down below. But if you want to be assisted instantly then you can call the customer care of the bank on their toll-free number: 1800 425 3800 and talk to their customer care executive.

YONO is a digital banking platform that lets the bank account holders of the State Bank of India access their bank account using the app. If you want to use the YONO application then you have to install it from the Google PlayStore or iTunes Store.

You have to enter the same username and password which you use to login to your State Bank of India internet banking.

You can install the mobile application from the official links of the Google PlayStore and the iTunes Store. You should never install the application from any of the third-party links or websites.

You can withdraw maximum of Rs. 10,000 per YONO Cash transaction.

When you create a new request of YONO Cash you will be receiving an SMS which will be having the transaction number. You have to enter this transaction number into the ATM Machine.

You have to set a 6 digits PIN which acts as the 2-factor authentication for your YONO Cash transaction.

YONO Cash is a feature that lets the account holders of SBI withdraw money from the ATM Machines without using the ATM Card or Debit Card. A unique transaction ID will be generated and secured with a PIN which will be later used to withdraw money without using the ATM Card or the debit card.

The full-form of YONO is You Only Need One.

Yes, you can withdraw money from SBI ATM Machine without the ATM Card using the YONO Cash Feature.

The first thing which you need to do is open the YONO application, tap on YONO Cash, Tap on ATM, Enter the amount, Set 6 Digits YONO Cash PIN and tap on Confirm.

There is no need for activating the YONO in SBI. All you have to do is download the YONO application from the Google PlayStore of iTunes and enter the username and password of your internet banking to login to your YONO application. What is YONO by SBI?

Where Can I Find Username and Password of YONO Application?

From Where Can I Install the YONO by SBI Mobile Application?

What is the Maximum Amount I Can Withdraw using YONO Cash?

What is YONO Cash Transaction Number?

What is YONO Cash PIN?

What is YONO Cash?

What is the Full-form of YONO?

Can I Withdraw Money from SBI without ATM Card?

How can I Withdraw Money from YONO SBI ATM?

How Can I Activate YONO in SBI?