RBI or the Reserve Bank of India is the central governing body in India which controls all the banking related things in India. They keep coming up with the reforms which make the banking system in India more robust and better for both the banks and the account holders. Recently they have changed a few more things and contactless payments are one of them. Currently, the contactless payments of the cards have been disabled. If you wish to continue using the tap and pay feature of your IDFC First Bank debit card, then you will have to enable it. In this article, I will tell you how you can enable or disable tap and pay in IDFC First Bank.

The contactless payment technology of the VISA debit cards issued by the IDFC First Bank is an amazing feature. In this, you just have to tap your debit card on the POS machine and the payment will be automatically deducted from your bank account. There is no requirement of your signature or enter your PIN Number. But the maximum limit of the contactless payment is Rs. 2,000 INR. If you wish to pay more than Rs. 2,000 INR then you will have to use the card in the traditional way.

What is VISA Tap and Pay Feature?

When the matter of VISA Tap and Pay feature has come, let me explain to you about this is brief. Tap and Pay is a feature that we get with the cards which are powered by VISA. It is a contactless payment feature in which you just have to touch your card to the POS machine and the money will be automatically deducted from your bank account.

Here there is no requirement of entering the ATM PIN number for making the payment. But currently, the maximum limit of the contactless payment which you can make with the help of your VISA card is Rs. 2,000.

Recently in one of my previous article, I had told that currently most of the Indian Banks do not have a feature to disable or enable contactless payments in India. But now the IDFC First Bank has come up with this feature for its bank account holders.

Why the Contactless Payments of IDFC First Bank Debit Card is Disabled?

As I have already mentioned the Reserve Bank of India, keeps coming with new reforms to improve the banking system in India. According to the latest reform by the RBI, the contactless payments of the debit and credit cards should be disabled by the bank.

The main reason behind this step is to avoid the misuse of this feature.

If the cardholder is not using the contactless feature of the card or if he is not aware of the feature. Then it does not make any sense in keeping the tap and pay feature enabled for his or her card.

When the cardholder is not using or is not aware of this feature. And if he lost his card somewhere then his bank balance will be at stake.

Because anyone can just use the card to tap on the Point of Sale machine and their payment will be deducted from the bank account. This is nothing but the unauthorized use of the contactless payment technology. And to avoid such things RBI has come up with this reform.

My Attempt to Make Contactless Payment was Declined by the Bank!

Just before few days I was at a petrol station in my city and had refueled my bike. I have the person my IDFC First Bank’s Signature Debit Card. There were many people standing in the Quque to refuel, so the person who was tapping my card on the POS machine told me the payment failed.

I asked him to retry the payment, he did it again and the payment was failed. I was surprised by this and asked him what is the error he is getting? He told me that the bank denied the payment.

I took my IDFC First Bank debit card back and gave him my State Bank of India card and asked him to use the microchip was payment. Then the payment was made successfully.

Later I got an SMS from the bank which is mentioned below.

Dear Customer, as per the new RBI Guidelines, your contactless payment feature has been disabled. To activate, please log in to Internet Banking or contact phone banking for further details. Thank You. Team IDFC First Bank.

If you have received the same SMS from the bank then I am here to help you out with this case. I will tell you how you can enable the contactless payment for your debit card.

Before we proceed to the further part of this article and check out the procedure which you need to follow to enable or disable tap and pay in IDFC First Bank. I would like to tell you in brief about the bank where you hold your bank account.

About IDFC First Bank

| Type of the Bank | Private Bank |

| Traded As | BSE: 539437 NSE: IDFCFIRSTB |

| Industry | Banking and Financial Services |

| Predecessor | IDFC Bank and Capital First Limited |

| Founded | October 2015 |

| Head Quarters | Mumbai, Maharashtra |

How to Enable or Disable Tap and Pay in IDFC First Bank?

So to enable or disable Tap and Pay in IDFC First Bank for the debit cards issued by them, you will have to access the internet banking of your bank account. This means you should have internet banking credentials with you to do so.

The further steps which you need to follow are as mentioned below.

- Go to the official website of the IDFC First Bank.

- Click on Customer Login.

- Click on Personal and Business Banking.

- Enter your IDFC Bank Internet Banking Username.

- Enter your password and click on Login button.

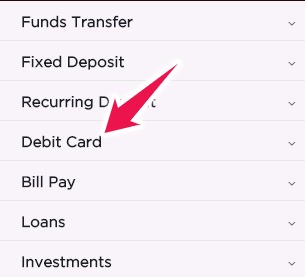

- Click on Debit Card.

- Click on Card Summary.

- Find your card and just toggle the button to enable tap and pay.

- Go to the official website of the IDFC First Bank.

- Click on Customer Login.

- Click on Personal and Business Banking.

- Enter your IDFC Bank Internet Banking Username.

- Enter your password and click on Login button.

- Click on Debit Card.

- Click on Card Summary.

- Find your card and just toggle the button to disable tap and pay.

Conclusion

So these are the steps that you need to follow to enable or disable tap and pay in IDFC First Bank. I hope you are clear with all the steps that are mentioned in this article. If you have any kind of doubts in your mind then feel free to comment down below. If you want to get assisted quickly right now then you can call the customer care of the bank.

Can I enable contactless payments offline?

No, currently there is no such option using which you can enable the tap and pay or contactless payments for your debit card offline.

Are there any extra charges for the contactless payments?

No, the bank will not charge you anything extra for the contactless payments you make with your debit card.

What is the Maximum tap and pay limit?

The maximum amount for which you can make the contactless transaction is Rs. 2,000 INR.

On What Technology Tap and Pay Works?

The VISA tap and pay works on NFC. (Near Field Communication Technology)

Will I Have to Enter my Debit Card PIN for tap and pay?

No, there is no need to entering your debit card PIN for the tap and pay transaction. All you need to do is tap your card on the POS machine.

Customer Care:

Customer Care: