There are many banks that are operating in India, there are many financial institutions that have been merged with other banks to form new banking institutions. We have many examples of this kind of merger and IDFC First Bank is one among those. IDFC Bank was merged with Capital First to form the current IDFC First Bank. And this is the best bank to deal with in India as far as my knowledge. Even I am one of the account holders of this bank. I maintain my primary bank account with this bank. In this article, I will tell you the procedure which you need to follow to change debit card limit in IDFC First Bank.

Here what I mean by the Debit Card limit is nothing but your ATM Card limit. I will explain everything which you should know about the limit and the usage of your ATM card which has been issued by the bank. Before we proceed to the further part of this article. I would like to tell you one thing and that is, you should never share your debit card or ATM card details with anyone.

I am talking about the details like debit card number, ATM PIN number, your CVV code, etc. If you get a call and they tell you that they are from the bank then make sure you don’t respond to them. If you receive such a call then it is a fraud call. Because nobody from the bank will call you and ask for your debit card details over the call or in person. So you should always make sure that you never disclose your card details to anyone.

If you receive such a call or SMS then don’t respond to them and inform the same to the bank. You can do that by calling the customer care of the bank on their toll-free number: 1800 419 4332. Talk to the customer care executive and tell them about the call or SMS you received.

How to Change Debit Card limit in IDFC First Bank?

There are two methods by following which we can change debit card limit in IDFC First Bank. I will be discussing both the methods in the further part of this article.

- Changing the Card limit Using Internet Banking.

- And Changing the Card limit Using Mobile Banking Application.

Both methods require your internet banking username and password. If you want to update the usage limit with the help of internet banking then you will require a desktop or laptop computer with a stable internet connection.

And if you want to update the usage limit using your smartphone then you will require the IDFC First Bank Mobile application installed. You can follow any of these methods to change debit card limit in IDFC First Bank.

Before I tell you the steps to change debit card limit in IDFC First Bank, I want to share some information with you. I have mentioned the things below.

What is Debit Card or ATM Card Usage Limit?

When we are talking about the Debit Card or ATM Card usage limit it becomes important for us to understand the real meaning of these terms. The debit card limit can be set both for the ATM machine withdrawal or the purchases we make in India (Domestic transactions) and also outside India. (International transactions)

The limit will be the threshold beyond which you can not make any transactions with the help of your debit card or ATM Card. I will explain these things to you with an example in the further part.

What are the Types of Debit Card or ATM Card Usage limit?

There are various types of limit that we can set or change for our IDFC First Bank debit card. They are as mentioned below.

- Domestic Withdrawal Limit.

- International Withdrawal Limit.

- Domestic Purchase Limit.

- International Purchase Limit.

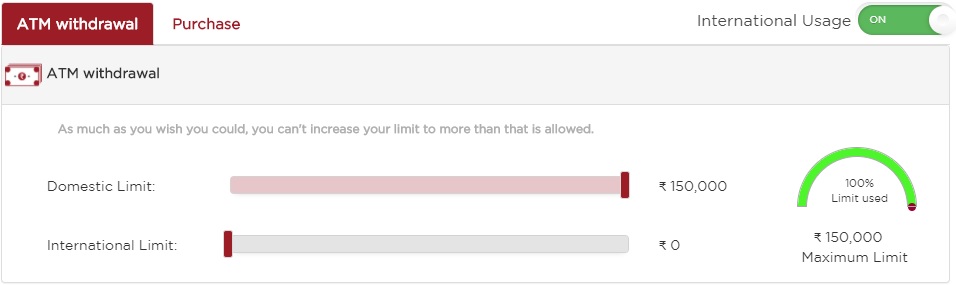

What is Domestic Withdrawal Limit?

This is the limit that is applicable to the daily withdrawals which we make within our country in India. You can only withdraw money out of the ATM machines in India to this set limit and not beyond the limit.

For example, let’s say that you have set your domestic withdrawal limit to Rs. 50,000 per day. Then you can only withdraw Rs. 50,000 per day and can’t do it beyond that in India. This is the meaning of the Domestic Withdrawal Limit.

What is International Withdrawal Limit?

This is the debit card limit that is applicable to the ATM withdrawals which you make outside in India in any of the foreign countries with your debit card.

For example, let us consider that you have set your international withdrawal limit to Rs. 30,000. And now you are in New York, United States.

You can withdraw the local currency of the United States which is equivalent to Rs. 30,000 and not more than Rs. 30,000. This is how the international withdrawal limit works. I hope you understood how the domestic and international withdrawal limits work. I will be also telling you the steps which you need to follow to change the debit card limit in IDFC First Bank.

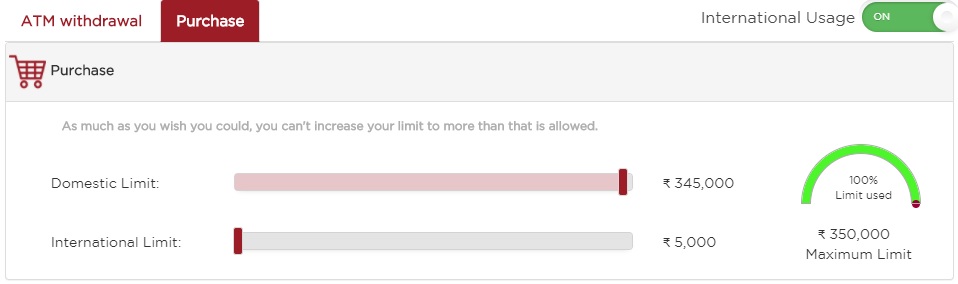

What is Domestic Purchase Limit?

There is a difference between the withdrawal limit of your debit card and the purchase limit of your debit card. And when we talk about the domestic purchase limit it is about the transaction which you can do using the POS (point of sale) device and the online purchases which you can make on the e-commerce websites.

For example, let us consider that there is a domestic purchase limit of Rs. 3,50,000. Then you can purchase products worth up to Rs. 3,50,000 only and not beyond that.

If you are planning to purchase some branded furniture products online (Indian E-Commerce) whose worth is Rs. 3,60,000 then you can not make that purchase with the help of your debit card.

Because the price of the product is more your debit card’s domestic purchase limit.

What is International Purchase Limit?

Just like the domestic purchase limit, even this is a kind of purchase limit itself. But this works for the purchases which you make in other countries and not in India. Usually, the international purchase limit will be less than the domestic purchase limits.

You should note one thing and that is this is not related to the transactions that you make in the ATM machines in other countries.

This limit is applied in the Point of Sale transactions that you make in other countries and the purchases you make on the international websites.

If you want to use your IDFC First Bank ATM Card on PayPal then you will need to activate the international usage first and check for this International Purchase limit.

How to Change IDFC First Bank ATM Card Limit using Internet Banking?

Now we know quite many things about the debit card or ATM card limits in India and outside India. Let us now check out how you can change your IDFC First Bank ATM Card Limit online using the internet banking function of the bank.

- Go to the official website of the IDFC First Bank.

- Click on Customer Login.

- Click on Personal and Business Banking.

- Enter your IDFC Bank Internet Banking Username.

- Enter your password and click on Login button.

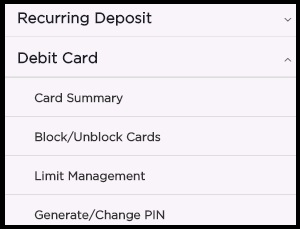

- Click on Debit Card.

- Click on Limit Management.

- Select the Debit card or ATM card whose limit you want to change.

- Click on ATM withdrawal to set your withdrawal limits. (Both Domestic and International)

- Click on Purchase to set your purchase limits. (Both Domestic and International)

How to Change IDFC First Bank ATM Card Limit using Mobile Banking?

If you want to use this method to change your ATM card limit of IDFC First Bank then you will have to first download and install the IDFC First Bank mobile banking application on your smartphone.

But you should make sure that you download and install the app only from the trusted sources. You should only rely on Google PlayStore or iTunes for this application. You should never make use or apk files or apk distribution websites to install banking applications.

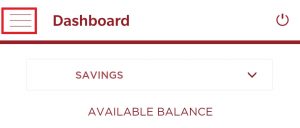

- Open the mobile banking application of IDFC First Bank.

- Enter your username and password.

- Click on Settings on the dashboard.

- Click on Limit management.

- Set your domestic and international ATM limits.

- Enter the OTP you will receive on your registered mobile number.

- Click on Submit.

- Set your spending and withdrawal limits here real-time up to the maximum limit.

- Please click on the update limit after you have chosen the limits.

- You will receive OTP on your registered mobile number only.

- Never share your ATM PIN number, OTP, CVV or any other details.

- Make sure you never enter your username and password on third-party websites other than the official website of the IDFC First Bank.

Conclusion

So these are the two methods that you can use to change debit card limit in IDFC First Bank. I hope you are clear with all the details which are mentioned in this guide. If you have any kind of doubts then you can comment down below. For instant assistance, you can call the customer care of IDFC First Bank.

How do I Block my IDFC First Bank Debit Card?

There are 5 methods that you can follow to block your lost IDFC First Bank Debit Card. You can block it with the help of internet banking, mobile banking, visiting the home branch, calling the customer care and by sending an E-Mail to the bank.

How do I Unblock my IDFC Debit Card?

IDFC First Bank allows their account holders to unblock the debit card. You can unblock the card with the help of internet banking and also mobile banking. To unblock your IDFC First Bank Debit card, login to your internet banking account. Click on Debit Card and then click on Block/Unblock debit card.

How can I use my debit card in ATM first time?

In case of IDFC First Bank ATM Card you can use it normally, once you have activated your ATM Card with the help of internet banking or mobile banking application. There is no special way to use your debit card in the ATM machine for the first time. Just dip in your card and enter your PIN number and you are good to go with the ATM machine transaction.

How do I Activate my IDFC First Bank Debit Card?

You can activate your IDFC First Bank debit card by using the internet banking function of the bank by visiting the official website of the bank or using the IDFC First Bank Mobile Banking Application.

Can You use a Debit Card at an ATM?

Yes, you can use your debit card at any ATM machine. Because the ATM Card and Debit Card are one and the same. There is no difference between a debit card and an ATM card.

What are the different types of debit cards?

Basically, there are two major types of debit cards and they are domestic cards and international debit cards. In the case of domestics debit cards you can use it only in India whereas in the case of international debit cards you can use it in any of the ATM machines, POS machines and E-Commerce websites across he world.

How can I withdraw money from ATM without pin?

There is no option to withdraw money from ATM without entering your ATM PIN number at IDFC First Bank currently. You will have to enter the PIN Number if you want to make any kind of ATM transaction with your IDFC First Bank card.

How do I create a PIN for my debit card?

You can create 4 digits PIN for your IDFC First Bank debit card with the help of the internet banking and mobile banking application of the bank. You will have to enter the OTP you receive on your registered mobile number in order to create PIN for your ATM Card or Debit Card.

How do you withdraw money from a debit card?

To withdraw money from your IDFC First Bank Account with the help of a debit card. You will have to insert your debit card into the ATM machine, enter your 4 digits ATM PIN, choose cash withdrawal function.

How do I contact IDFC Bank?

If you want to contact IDFC First Bank then you can do that by calling them on their toll-free number: 1800 419 4332.

Can someone use my ATM card without my PIN?

The answer to this question is in some cases, yes and in some cases no. It depends upon the type of debit card you have with you. If you have a domestic only debit card then the chances are very less that someone can use your ATM card without your PIN number. But if you have a contactless international card then yes, it can be used without your ATM Pin number up to a transaction of Rs. 2,000.

Customer Care:

Customer Care: